In this article, we have chosen to conduct an in-depth overview and analysis of the key points we previously highlighted, based on the broader picture and the developments we anticipated, insights that could help an investor select the right strategy and seize investment opportunities in the most suitable way.

From the analysis at the start of the year to the latest developments, the first half of 2025 has confirmed, both on a macroeconomic and investment level, that strategic thinking and a calm, rational reading of the data remain invaluable tools.

The first half was not merely a period filled with challenges and turbulence, it was also a phase of confirmation. The trends we identified early on, from geopolitical tensions to monetary policy decisions and market reactions, moved beyond the realm of scenarios. They materialized, validating those who were able to read the signs in time. In the world of investing, timing and positioning are of critical importance. They can result in either considerable losses or returns. The six-month recap offers valuable insights into what lies ahead.

January

Let’s begin with our January articles, in which we had pointed out the elevated levels of oil prices (at $78 WTI and $81 Brent) and our forecast for an imminent correction of around $7–10 downward, a move that was eventually confirmed. In subsequent articles, we also emphasized that this correction would create support levels and entry points for strategic buying opportunities around $60 WTI.

In January, as in later updates, we referred to the historically low levels of the Baltic Dry Index and projected an upward trajectory from 1,000 points toward 1,260, 1,650, and 2,000 points. The 2,000 point level was tested twice, and as we noted in a previous analysis, we expected a breakout above that threshold as well. Our broader view of the shipping sector remains unchanged: we are witnessing the beginning of a “golden era” that could last 5 to 10 years.

Additionally, in the same month, we warned of heightened volatility and nervousness in the markets expected over the next three months, and throughout 2025, largely driven by Trump and the wave of announcements tied to his pre-election commitments. We also underlined the importance of his initial actions, aimed squarely at revitalizing the American economy.

February

February began with a sharp correction triggered by DeepSeek, and we continued to emphasize our view of a further downward trajectory in oil prices, forecasting levels below $70. At the same time, we maintained a positive outlook on the continued upward movement of the BDI.

We also highlighted the statistical importance of this month, traditionally seen as one that follows the momentum of January. Once again, we reaffirmed our prediction of sustained market volatility from January through the end of April, something that did in fact play out.

Notably, February marked the first Federal Reserve meeting of 2025. We expressed a clear divergence from Powell’s stance, particularly regarding the number of rate cuts anticipated for the full year. Our disagreement extended to his contrast with Trump’s monetary policy vision, which favors significantly lower interest rates. That divergence continues to this day, with Trump now adopting an increasingly aggressive tone against Powell, as signs of declining inflation have become evident over the past three months.

Powell, however, still justifies the lack of rate cuts by citing the ongoing issue of tariffs, an area that remains unresolved, despite the most recent short-term extension through August 1st. In our view, these extensions are likely to continue at least through the end of August, when certain key tariff applications on Chinese goods are due to expire.

In our February articles, we continued to highlight major investment opportunities in value and transportation sector equities. We also discussed the historical significance of the new administration’s first 100 days, statistically, a period associated with bullish momentum in the markets. This time, however, things played out differently. As we noted in one of our articles, such a deviation from historical behavior had not occurred since 1928. Nonetheless, the outcome proved highly rewarding for investors who recognized this statistical anomaly as a strategic buying opportunity.

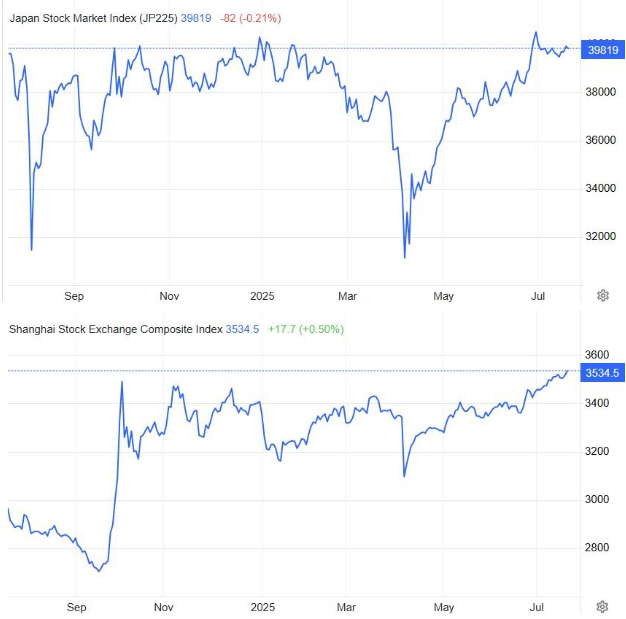

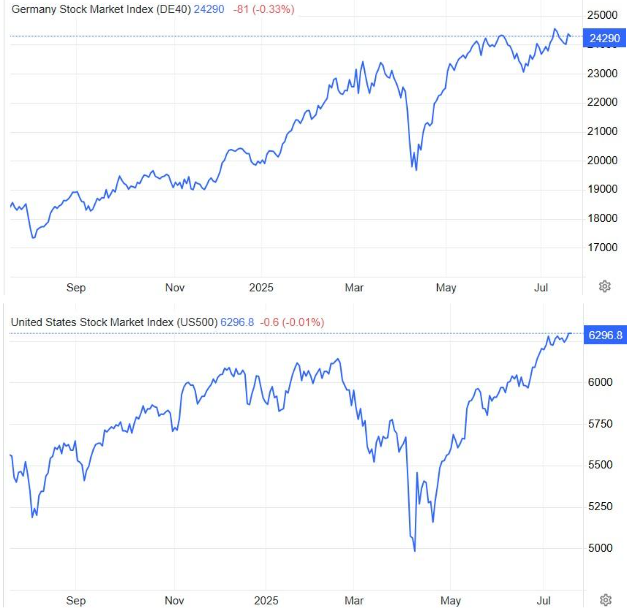

Finally, as early as February, we had identified the €68 technical level as a key support point for EUAs. We also underscored the notable divergence in performance between global equity indices, most of which outside the U.S. were posting strong positive returns, while U.S. indices remained in negative territory since the beginning of the year. We viewed this as an additional positive signal for selective positioning, something that has since been validated, as non-U.S. market returns have moderated from their earlier highs, while U.S. markets have moved back into positive territory. We continue to believe that by year-end, the U.S. indices will deliver substantial gains, potentially even surpassing those of other regions.

March

In March, we emphasized the end of the first quarter as a key milestone for the markets, along with the major developments and opportunities we expected to emerge from President Trump’s strategic direction, particularly regarding geopolitical matters (Ukraine and the Suez) and his stance on tariffs and interest rates.

That month also marked the first time Powell’s rhetoric did not appear overtly opposed to Trump. He even suggested that a rate cut might be possible within the first half of the year. It was around this time that inflation indicators began to show a consistent downward trend, as we had already pointed out earlier.

Market volatility remained elevated in March, with daily fluctuations in most asset classes. Yet, as we stated then, and continue to believe, it was a period that offered a distinct advantage to investors looking to position themselves with a two-year outlook. Substantial discounts appeared across various sectors, including shipping, which we had already identified as a particularly attractive area.

This month also marked our first mention of a potential speculative rally in the EUR/USD exchange rate, with a projected move toward the 1.1300 level. We believed the driving force behind such a move would be the reallocation of investment capital away from the U.S. dollar. At that level, the exchange rate would enhance the attractiveness of U.S. assets, both bonds and equities, for European investors. This view was expressed despite our broader long-term forecast for the euro to fall below parity during Trump’s term.

It’s no coincidence that two of our March articles carried the title “Make America Great Again.” That phrase perfectly encapsulated our alignment with Trump’s strategy, and the results it was beginning to deliver. This became further evident in the data released in June, when the U.S. recorded its first monthly budget surplus since 2017.

April

As March and the first quarter ended, the numbers spoke for themselves, revealing not only the undervalued trajectory of U.S. markets but also the enormous investment opportunities they presented. The divergence in returns between European and U.S. indices reached historic proportions, nearing 20% (roughly +10% for Europe versus -10% for the U.S.). At that time, we emphasized that global verbal pressure against Trump’s moves had reached its peak, and we might be witnessing the final act of this “drama.”

As we had already noted in previous articles, key levels for entering value stocks have now been confirmed in practice. Many equities had reached oversold levels and were trading at exceptionally low P/E valuations, clearly diverging from the broader negative market sentiment.

In the early days of the month, the wave of negative rhetoric had already served its purpose: it had created the illusion that President Trump was indifferent to market performance. Meanwhile, we saw a growing number of companies announcing investment plans within the U.S. to avoid tariffs. At the same time, analysts began discussing the possibility of 3-4 rate cuts in 2025, an outlook we had embraced from the start. Technology stocks were trading at lower P/E ratios compared to the previous quarter, and as we pointed out in our analysis, investment opportunities now spanned a significant portion of listed U.S. companies.

The day of the tariff announcements, in our view, marked the conclusion of the “undervaluation narrative.” We had already predicted that there would be an intervention to stabilize the markets, initially assuming it would come from Powell. However, just hours before the official announcements, Trump himself declared it was the best time to buy stocks. The very next day, the announcement of a tariff extension sparked one of the biggest single-day rallies in U.S. stock indices in the past 40 years.

During this month, we also focused on the U.S. debt-to-GDP ratio and the country’s need to rebalance that equation to achieve a “reset” and full-scale restart. We supported this analysis with quantitative data, highlighting the benefits of:

- positive developments on the tariff front,

- the temporary ceasefire in Ukraine (a 30-day extension),

- upcoming interest rate cuts,

- falling yields on U.S. bonds back to 2022 levels (where the prior rally began),

- the $7 trillion parked in money market funds (held outside the market due to fearmongering),

- the rising trend of the BDI index, which clearly contradicts any “recession narrative” heavily promoted by mainstream media.

Looking at market and stock performance since then, it’s worth reflecting on how an investor should behave during such periods. This particular phase simply lasted longer than expected, statistically. April marked the end of Trump’s first 100 days in office and fully validated the headline we had chosen: “The Great Reset.” It was the beginning of a bullish momentum that still persists and which we believe will intensify as we move into the heart of earnings season, a key catalyst expected to further fuel the market’s upward trajectory, particularly through August.

May

Starting in May, markets began to move in a more subdued and orderly fashion, primarily due to the extension of tariff implementation. Investors gradually started to decode the likely future developments. Given that Trump had, up to that point, reached a tariff agreement only with the United Kingdom, we maintained our view that the truly positive news still lay ahead, an outlook that fueled several upward moves during the month.

The first significant bullish impulse came on May 9th, following the announcement of reduced tariffs on China and the proposal to apply a uniform 10% rate to all other countries. Since the market had previously priced in much higher levels, this move triggered an immediate positive reaction in U.S. equities. As we had already stated, valuations in the U.S. stock market were at highly attractive levels.

We had already highlighted that oil around $60 represented a favorable entry point, with initial targets set at $67 and $73. This upward movement began and continued throughout May, reinforcing the overall positive market sentiment. From the April lows, U.S. indices posted gains exceeding 15%.

Additional support came from the massive investments Trump secured through various trade deals, investments amounting to over $6 trillion committed within the U.S. economy.

In our May articles, we also emphasized the significant opportunities emerging from artificial intelligence (AI). The performance of related companies since then has fully confirmed our position. Moreover, we underscored the broader sectors poised to benefit from the AI revolution, just as we had forecasted.

The transportation sector and the BDI index continued to validate our view, delivering double-digit returns from the April lows. All of this underscores the value of targeted, strategic positioning in periods of uncertainty.

June

June was a pivotal month, marking the close of both the second quarter and the first half of the year. As we had emphasized in our articles, we view this as a guiding month, one that will shape the direction of the markets for the remainder of the year.

Our broader view remains unchanged: the market’s upward reaction has yet to display its full potential, as it continues to digest the previous period’s developments. Investment opportunities remain both numerous and significant, while upcoming announcements will play a critical role in defining the next leg of the cycle. As we wrote in the title of one of our June articles: “Markets Continue to Move to Washington’s Rhythm.”

During the month, our oil target of $73 was met, even if driven by the Israel–Iran tensions. Meanwhile, speculative behavior in the EUR/USD exchange rate continues. According to our projections, the first resistance level for a correction lies around 1.1600, with the next target at 1.1200.

The upward movement of the BDI toward 2,100 points, as highlighted in our June articles, has also been confirmed. As we continue to stress, investment opportunities are clearly present, especially during periods like the one we are currently experiencing, something that has been evident since the start of the year.

This article was not written merely to highlight the accuracy of our past forecasts. Undoubtedly, it is important for an advisor to stay ahead of developments, assess the cost of each decision, communicate experience in a clear and comprehensible way, and explain the basis of their analysis to investors.

With 29 years of experience in the field of investment services, I aimed to show just how important it is not to fall for the “siren calls” of fear when investing, as we’ve said in the past, but instead to decode developments, announcements, the pace and nature of change, their costs, and, above all, their benefits in a strategic and methodical way.

Ultimately, the goal is to define, together with your investment advisor, a strategy that performs well during uptrends and remains defensive during downtrends, maximizing the efficiency of your capital.

This is my professional philosophy: an advisor should stand beside the investor, not opposite them, pointing fingers. This has been my approach for years, and it is the approach we instill in every team member within our firm.

Investing is the most powerful endeavor for anyone who wants to see meaningful returns on their capital, especially in the next four years. Keep that in mind, along with everything we’ve outlined in each of our articles. Who knows, maybe we’ll be right about that, too.

An Invitation to Maritime Economies Readers

We are pleased to offer a complimentary portfolio evaluation service to all our readers. Through back testing and using our proprietary tools, we will assess whether the risk you are currently exposed to aligns with your goals and expectations.

With this in mind, we strive to help each investor see the “big picture” and move forward with knowledge, strategy, and discipline.

As we always say: The greatest returns are often born in times of uncertainty.

by Kotsiakis George