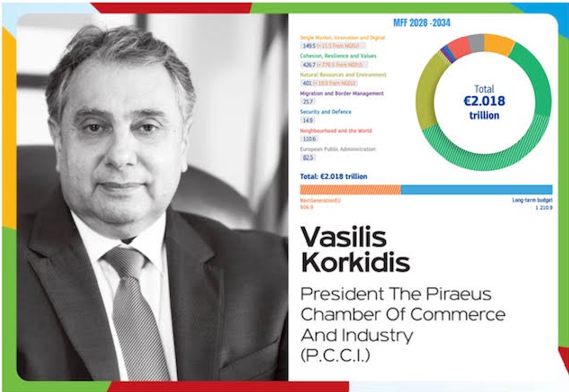

There are strong objections from at least 13 EU member states to the new seven-year budget proposed by the Commission for the period 2028-2034, which reaches 2 trillion euros. In the College of Commissioners, the objections focus on the difficulties in terms of the EU's ability to respond to current and future challenges. Also in the competent budget committee of the European Parliament, the rapporteurs of the two largest Eurogroups, the center-right European People's Party and the Socialists and Democrats, rejected the proposal, while they even questioned the amount of 2 trillion euros, as they pointed out that it also includes the loans of the pandemic period, through the “NextGenEU program”,which must be repaid.

The two-year negotiations for the Multiannual Financial Framework are therefore expected to begin in a difficult climate, as in addition to the European Parliament, the Commission's overambitious proposal has already caused reactions in the member states of the European Union. The European MFF is mainly financed by national contributions, with the most economically powerful countries being its largest contributors, while other revenues come from taxes. Therefore, the new proposal, increased by 64% from the previous one, includes a series of new taxes or "own resources", which are expected to raise a total of 400 billion euros over seven years, while companies with an annual turnover of 100 million euros, electronic waste and tobacco products are targeted.

Despite the fact that the Commission President herself insists that member states will not have to increase their contributions, large member states such as Germany, the Netherlands and Sweden are reacting by claiming that the size of the fund is excessive and unacceptable, calling for “smart” management instead of simply increasing spending. France, despite its austerity national budget, seems to support the plan, highlighting its importance for defense, competitiveness and support for farmers. Hungary denounces the budget as being too close to Ukraine with the special provision for 100 billion euros in aid, while rejecting the combination of funds with policies of pressure on immigration.

Similarly, the countries of the European South are also opposed to the proposed merger of cohesion policy and the Common Agricultural Policy (CAP), which now cover 2/3 of the budget. The CAP funds are expected to be reduced by up to 30%, despite the fact that approximately 300 billion euros are secured for farmers, 218 billion euros for the regions and for the first time 14% of the funds will be allocated for social spending and for the management of migration. The Commission considers the creation of a separate “crisis mechanism” of 400 billion euros, which will be allocated exclusively in case of emergency, to be an innovation. Also, according to the Recovery and Resilience Fund model, member states should present “national and regional plans” in order to “unlock” the resources through proposed reforms and investments.

The MFF may try to cover all areas and satisfy all those who expect support for growth, competitiveness and the twin transition, but there are doubts about whether the funding will reach European businesses to meet their expectations. Everything will depend on the details of the various elements and the future annual work programmes of the various actions. Out of the €2 trillion, corresponding to 1.26% of EU GNI, the funds for SMEs must be ring-fenced and cannot be used by larger businesses. Therefore, an enlarged composition of a Strategic Stakeholder Board would be useful to at least ensure that the interests of SMEs are respected.

Everyone seems to agree on the goal of regaining digital leadership in the EU, which must however cover the entire required digital field with an increase in funds to 450.5 billion euros for research and innovation. Artificial intelligence factories, cloud technologies, 6G, must reach the entrepreneurship of each region and infrastructures must not remain accessible only to large cities. In addition, the digitization of the public sector in all EU-27 countries is imperative if we want to complete the effort to simplify a single market based on data. A European Social Fund should constantly aim at the employability of the potential workforce and increase the mobility of the labor market in the digital transition.

The Clean Transition and Industrial Decarbonisation of the new framework rightly continue to include the green transition for the European SMEs. However, the proposal to collect pan-European taxes and fees of €42.8 billion per year from “E-Waste Tax” and CBAM on pollutants and waste, from companies’ own resources and direct contributions from Member States, is controversial to ETS and is seen as counterproductive and sending the wrong message in times of reduced competitiveness and ongoing trade conflicts. Particular concern to business is the Corporate Resource for Europe (CORE) a new annual levy on companies with EU turnover above €100M, which consequently will have impact to all companies and consumers.

The tripling of the Solidarity Fund’s spending to address extraordinary crises and natural disasters also cannot be financed by additional private insurance charges from businesses and households.

The €85 billion cut in the Common Agricultural Policy for the new programming period is causing objections, which corresponds to a reduction of over €2 billion from the €19 billion in Greece's CAP. A total of €865 billion is foreseen in the allocation of funds for agriculture, fisheries, cohesion and social policy. Turbulence within the EU is also expected to be caused by the two large funds of the new budget structure, on the one hand the €200 billion for external action, of which €100 billion concerns Ukraine, and on the other hand the €131 billion for defence and space. The single Asylum, Migration and Border Policy funds program is causing confusion, with a focus more on surveillance than on integration.

The next two years, before the new MFF takes final shape, are certain to raise many divisive questions, as it merges 52 programmes into 16 and will create a field of fierce debate in the EU. In accordance with intra-Community procedures, the EU General Council described the proposal as “authoritarian” and “mysterious” due to a lack of transparency and the late incorporation of comments in the final text. The European Parliament states that the budget “does not work out mathematically”, and that it is a spending freeze rather than a substantial increase. Environmental and social organizations speak of a “degraded graph”with a lack of binding support for green spending. Businesses believe that 25% should be directed to digital technology instead of 7% focused on commercial orientation. Local and regional authorities fear that merging funds into “national-regional plans” will exclude municipalities, failing to serve local needs, and others believe that focusing on national plans exceeds local government participation, undermines cohesion and creates remote actions.

Summarizing, political and national reactions are due to 4 main reasons, economic pressures, strategic priorities, democratic participation and conflicting ideologies. The states contributing to the European budget do not want further budgetary burden, while the plan insists on domestic resources, but paradoxically without an increase in national contributions. The large increase in funds for Defense, Migration, and support for Ukraine leads to concerns about the diversion of resources from agricultural and environmental policy. National parliaments are asking for participation, fearing a concentration of power at European level, and finally the parliamentary majority in Brussels questions the need for more and calls for a balance between opportunity and responsibility.

Greece’s official position is focused on the issues of the allocation of MFF 2028-2034 funds regarding the autonomy of the CAP and social cohesion, the abolition of the tobacco tax, fair distribution especially for SMEs and local businesses, and transparency. Greece, with a joint intervention with Italy and Spain, signed a “non-paper” calling for the CAP and Cohesion Policy to be maintained as separate funds, instead of a single “national pot” with autonomous budgets and not consolidated as a “one-fund”. Greece is pushing for funds for farmers and fishermen to be secured through autonomous frameworks, due to concerns that pooling funds could reduce their access. Greece is also reacting to the proposed charges and strongly opposes the taxation of tobacco products, which is included in the EU’s new “own revenue” tax category. Greece, in view of its EU presidency in 2027, is calling for clear accountability in the handling of funds, without mergers, without additional taxes, with the aim of supporting SMEs and balanced national participation.