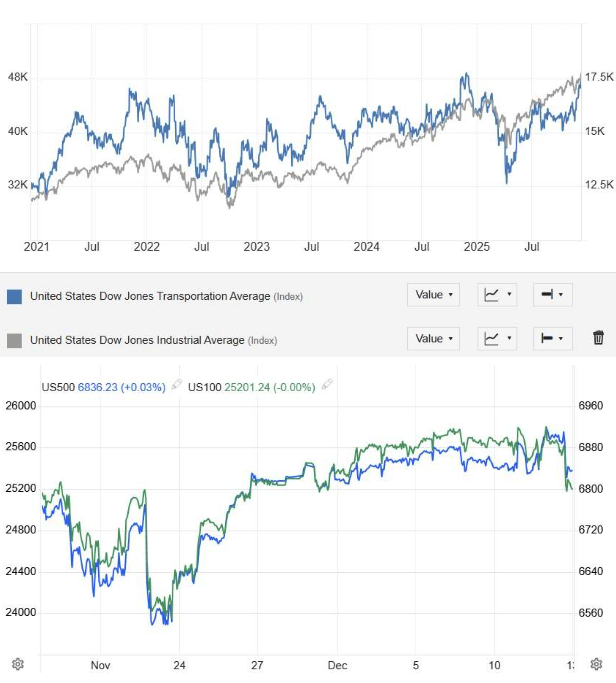

Over the past ten days, the investment landscape has shifted in a way that is more complex than it appears at first glance. Prior to the FED’s decisions, markets were operating under the core narrative that monetary easing would be limited, cautious, and tightly controlled. Growth was viewed as resilient, but not strong enough to justify aggressive rate cuts, while 2026 was seen as a year of gradual normalization rather than a radical shift in policy.

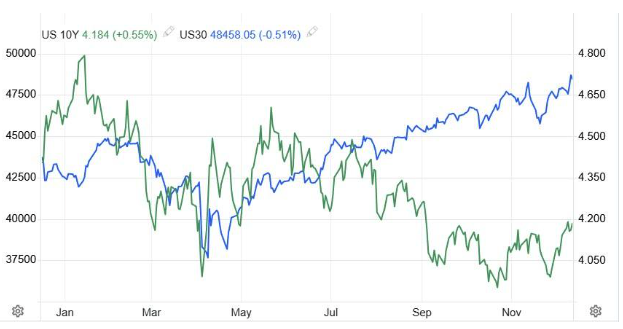

This picture began to change following Wednesday’s announcements. The rate cut, combined with the announcement of bond purchases amounting to USD 40 billion per month, sent a clear signal that the FED is seeking looser financial conditions and enhanced liquidity support. At the same time, Powell’s change in tone, referring to stronger growth in 2026 compared to previous statements, indicated that the central bank no longer views the economy through the lens of an imminent slowdown.

However, market reactions were not linear. On Friday, equities declined, while the euro strengthened and gold moved modestly higher. This behavior does not negate the positive signals from the FED, rather, it suggests that investors began shifting from immediate relief toward a broader reassessment of risk. Within this environment, Russia’s lawsuit against European countries over the seizure of Russian assets, along with its stated intention to seek compensation, introduced an additional legal and political source of uncertainty for Europe.

Europe’s stance on the Ukraine conflict remains firm, however, the potential use of frozen Russian assets sets a serious and far-reaching precedent. Should Europe move in this direction, the cost could prove structural rather than temporary: legal challenges and compensation claims, erosion of confidence in the European institutional and legal framework, and a sustained increase in country risk of the country’s investors who have, until now, regarded the Eurozone as a safe and predictable investment jurisdiction. This risk becomes even more pronounced if the war moves toward a political settlement without European participation, if Trump pressures Zelensky into an agreement to end hostilities. Under such a scenario, Europe risks becoming geopolitically exposed and economically weakened, having committed political and fiscal capital to a strategy it does not control.

At the same time, markets are gradually looking beyond the immediate monetary environment and beginning to price what may come next. In this context, particular attention should be paid to Donald Trump’s statement on Friday, in which he suggested that one year from now interest rates could be at 1% or even lower. Currently, market pricing for 2026 incorporates total rate cuts in the United States of around 0.5%. This represents a conservative scenario, clearly milder than what Trump publicly advocates, as he has made clear his preference for significantly lower interest rates. As we have repeatedly noted in our articles, and as is consistently emphasized by Miran in the latest meetings in which he participates, a substantive

shift in policy may occur after the end of Powell’s term, with the appointment of a FED Chair chosen by Trump and capable of implementing more aggressive monetary easing.

Within this framework, markets are not pricing only what is happening today, but who will be making decisions tomorrow. The strengthening of the euro, the modest rise in gold, and increased equity volatility reflect a market attempting to balance short-term FED support against longer-term political and geopolitical uncertainty.

Looking ahead to the coming week, investors should closely monitor developments surrounding international meetings on Ukraine, which may have a direct impact on European risk, as well as the expiration of derivatives contracts (19/12/2025 triple witching), which traditionally increases volatility and may amplify short-term moves that do not necessarily reflect the underlying fundamental trend.

Shipping stands out as one of the few sectors capable of benefiting simultaneously from multiple scenarios. A potential positive development in Ukraine, combined with lower global interest rates, would act as a catalyst both for freight rates and for asset valuations. A de-escalation of geopolitical risk in Eastern Europe would help restore trade flows, reduce the risk premium in the transportation of energy and raw materials, and support activity in sectors that currently operate under a geopolitical “overlay.”

At the same time, a negative outcome for Europe stemming from its choices on Ukraine—particularly if it proceeds with the use of frozen Russian assets amid legal claims and compensation demands from Russia, would increase institutional and financial risk for the European economy. In such an environment, shipping, as a globalized industry with dollar-denominated revenues and mobile assets, functions more as a hedge against European risk than as a pure European exposure.

Of particular importance is the role of Greek shipping groups, which control approximately 60% of total European commercial fleet capacity in terms of deadweight tonnage (dwt), maintaining decisive influence over the operational flexibility and supply dynamics of European shipping. A positive development in Ukraine, whether through an agreement or political de-escalation, could prove disproportionately beneficial for Greek companies, both due to their scale and their ability to swiftly capitalize on changing trade conditions. Combined with a lower interest rate environment, which reduces the cost of capital and enhances asset values, shipping re-emerges not merely as a sector, but as a strategic investment choice during periods of geopolitical and monetary transition.

In this environment, the market message becomes clear: monetary easing in the United States, political uncertainty in Europe, and geopolitical developments in Ukraine do not operate independently, but converge into a new phase of capital reallocation. The FED is paving the way for a lower cost of money, even if full implementation of this scenario is deferred, while Europe is assuming elevated legal and political risk through its stance on Ukraine. Within this framework, shipping emerges as a strategic beneficiary. Markets do not wait for the outcome, they begin to price it in. And it is precisely this forward pricing that will shape the investment opportunities of the coming period.

In an environment where monetary decisions, geopolitical developments, and capital markets converge, correctly reading both timing and direction becomes critical for investors. At GEKODESK & PARTNERS, we systematically monitor these transitions and translate macroeconomic, geopolitical, and sector-specific developments into targeted investment strategies, fully tailored to each client’s risk profile and objectives. Our goal is not merely to observe the market, but to identify its next move in advance and strategically position capital during periods when major shifts create meaningful return opportunities.

Since the beginning of the year, through our analytical articles and investment guidance, we have highlighted in a timely manner a series of developments which, for those who assessed and acted upon them appropriately, translated into tangible returns. Our philosophy is not forecasting for the sake of visibility, but disciplined interpretation of structural changes and the prudent allocation of capital before these shifts are fully priced into markets. This is the core of our investment approach.

by Kotsiakis George