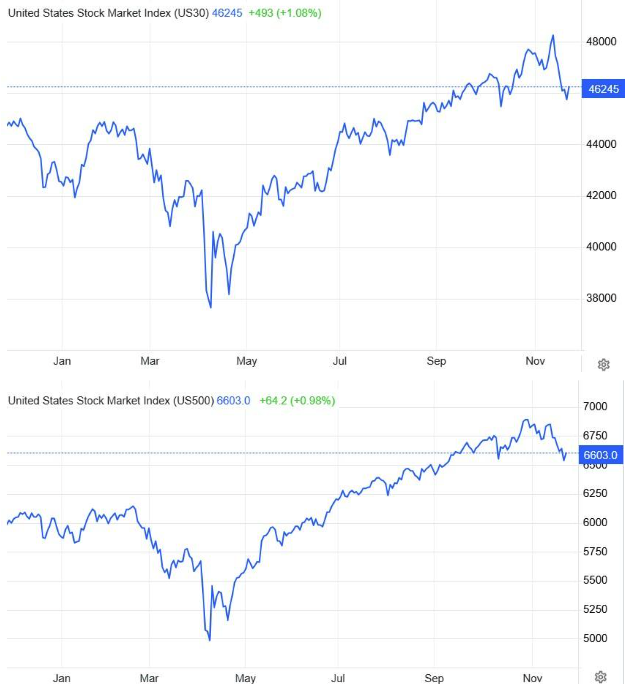

The week of Thanksgiving has historically shown a distinctly bullish character. From 1928 until today, the S&P 500 records a positive return in roughly 60–70% of cases, while Wednesday and Friday of Thanksgiving week consistently rank among the best days of the trading calendar. This year, however, seasonality is being tested.

Technology, the main pillar of recent years’ rally, has posted deeper losses despite the chatter about a “bubble.” At the same time, the earnings of major tech companies continue to exceed estimates, supporting their valuations and creating optimism for many firms in the sector. Nevertheless, several analysts keep forecasting in media a “classic” 10% correction.

Thanksgiving Rally alone, therefore, is not enough this year. The market is seeking larger and more substantial catalysts.

Markets are entering one of the most critical periods of the year, where the traditionally bullish Thanksgiving Rally meets increased volatility, corrections among major tech stocks, and a decisive shift in expectations regarding the Fed. The probability of a December rate cut has strengthened significantly, closing on Friday at 74% (The probability of a December rate cut, which ten days ago was near 95%, temporarily collapsed to 24% during the panic around the so-called “tech bubble,” only to rebound now toward 75% after employment and unemployment data.)

As I have mentioned in a previous article, our view for a 0.50% rate cut in December in the U.S. has now begun to appear as a possible scenario, laying the groundwork for a potential Santa Rally toward year-end.

At the same time, the prospect of a peace solution in Ukraine (our view is that this will happen within the next few days, and, as I have consistently stated since the beginning of the year in all our articles, the resolution of the Ukrainian conflict will be completed by the end of 2025. Recent developments seem to confirm us in this major evolution of the year) strengthens an entirely different scenario: a Peace Rally that could reduce geopolitical risk, boost global transport flows, and unlock investments of hundreds of billions or even trillions for reconstruction.

Europe, however, risks remaining on the sidelines due to ongoing sanctions and anti-Russia sentiment, as I have repeatedly highlighted, while the U.S. appears positioned to claim the largest share of next-day economic gains. The triad Fed, Geopolitical Crisis, Energy will determine whether 2025 closes with seasonal or exceptionally strong performance.

This year, though, the S&P 500 and Nasdaq entered this week tired, with intensified volatility and a correction originating from major tech names, after two years of overextended valuations in artificial intelligence and semiconductors—although up until ten days ago, it was justified. With the developments coming in the next few days, I am curious to see what all these so-called bears of the sector will have to say.

Investors must now shift their focus away from seasonality and toward the catalysts that can truly transform the existing bullish momentum: a Fed that is about to begin a rate-cut cycle, and the geopolitical shift.

The Fed was slow to recognize the new macroeconomic environment, insisting longer than necessary on outdated models, claiming it would maintain a stable policy until irrefutable signs of inflation decline appeared. Yet, within a matter of weeks, the backdrop has changed dramatically, and its earlier obsessions have proven to be the wrong policy.

The slowdown in the labor market, declining inflation, and weaker consumer dynamics have created the conditions for a shift in tone and a forced recognition of reality by the Fed. Now, the probability of a December rate cut has increased significantly, reaching 75%. This is a catalytic shift explaining why markets, despite the correction, remain resilient, and this is evident in the total market capitalization of the U.S. stock market: over the recent correction days, it dropped from $55 trillion to $52.5 trillion, whereas during the DeepSeek crisis, the equivalent drawdown was nearly $7 trillion.

If the Fed decides on a 25-basis-point cut, the Santa Rally becomes not just likely but potentially strong, according to analysts, meaning that if what was considered certain ten days ago actually materializes, markets will react positively. Even more so, under the scenario of a 0.50% cut, which Miran and not only Miran consider desirable.

Beyond the Fed, the second major factor is the geopolitical crisis.

The announcement of peace progress in Ukraine, either a ceasefire or a framework agreement, could trigger the largest risk-on wave of recent years.

What would a Peace Rally mean?

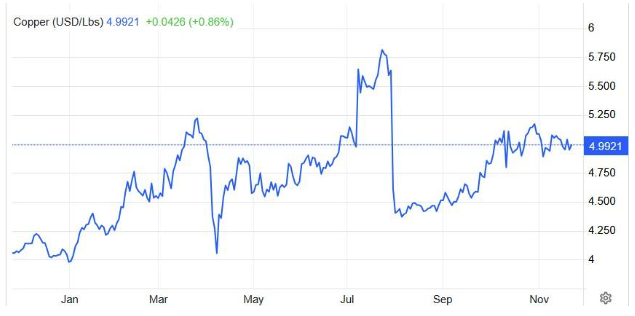

A reduction in geopolitical risk premium, boosting cyclicals: industry, banks, transportation, logistics. Energy de-escalation, with energy prices correcting from war-related premiums, supporting global industrial production and shipping costs.

Reconstruction of Ukraine, with agreements worth hundreds of billions in the initial phase, and a decade ahead requiring massive investments in infrastructure, energy, telecommunications, ports, and raw materials.

U.S. companies have already begun positioning themselves strategically through funds, investment structures, and diplomatic arrangements. Europe, on the other hand, remains bound by long-term sanctions.

The EU is in its most difficult investment phase since the debt crisis.

Committed to successive sanction packages and politically unable to reverse them, along with ideological fixations, as I have already noted, Europe risks being:

- excluding reconstruction projects,

- excluding energy agreements,

- excluding access to raw materials,

- excluded from Russia–Ukraine capital markets,

- and excluded from the next major investment cycle.

Today, Europe is at its weakest point in decades: still enforcing the 19th sanction package, committed to full disengagement from Russian energy by 2027–2028, unable to participate in investments in Russian companies and markets, and at risk of being excluded from major Ukrainian reconstruction projects due to political restrictions.

And when political weakness meets energy dependence and fiscal fatigue, the market delivers its message through the exchange rate.

This is reflected in the EUR/USD, which shows investors trust U.S. prospects far more.

With peace, the Black Sea returns to the global trade map, generating:

- A surge in dry bulk due to reconstruction materials

- Re-routing flows in crude & product tankers

- Increased volumes in containers from new projects and infrastructure

- Strengthening of global trade overall

Shipping could become one of the biggest beneficiaries of the next decade, a true “post-war” investment story.

In an environment where changes will be abrupt and large-scale, early positioning is not optional, it is essential. The end of the Ukrainian war will create a colossal investment opportunity in which the U.S. will play the leading role. Those who move early will be able to capitalize on this power shift. And now is the ideal moment for a serious investor to speak with an experienced investment advisor, design the appropriate strategy, and avoid impulsive moves that lead to mistakes. Opportunities will open ahead of us, but they will reward those who prepare with planning and discipline, not those who chase headlines.

Investment Roadmap

- Mapping Goals & Risk

Clear identification of goals, time horizon, and risk tolerance.

- Discussion with an Experienced Investment Advisor

The timing is ideal for preparing a strategy before the new investment cycle begins.

- Timely Strategic Positioning

U.S. companies, energy, shipping, infrastructure, and sector-specific investments form the core pillars.

- Diversification & Discipline

Proper capital allocation and avoidance of over-concentration.

- Continuous Monitoring & Adjustment

The coming year will bring major changes at high speed; strategy must be continuously monitored and adjusted accordingly.

The market will wait for no one. The new investment wave will begin the moment the Fed and geopolitics deliver the first clear signal. Those who have prepared will enter the next cycle from a position of strength. The rest will chase the trend.

by Kotsiakis George