As we have emphasized in all our articles since the beginning of the year, 2025 is emerging as a landmark year for global markets. The deliberate political fluidity in the United States, the ongoing geopolitical tensions in Eastern Europe and the Middle East, along with the shifting and often contradictory stance of central banks toward inflation and interest rates, are shaping a landscape full of opportunities. In investment strategy, however, this economic reality is not necessarily an obstacle,it can become a window of opportunity for those prepared to move with composure, foresight, and flexibility.

Global investors are required to constantly reassess their positions, shield and reshape their portfolios, and most importantly identify the value zones that emerge through volatility. Technology stocks, commodities, energy, and the currently undervalued U.S. dollar (which has lost its highest percentage value in a six-month period since 1973 and closed on June 30th at 2021 levels) are creating new dynamics. At the same time, the re-emerging political presence of Donald Trump in the U.S. scene adds yet another critical factor of hope, depending on one’s investment outlook and strategy.

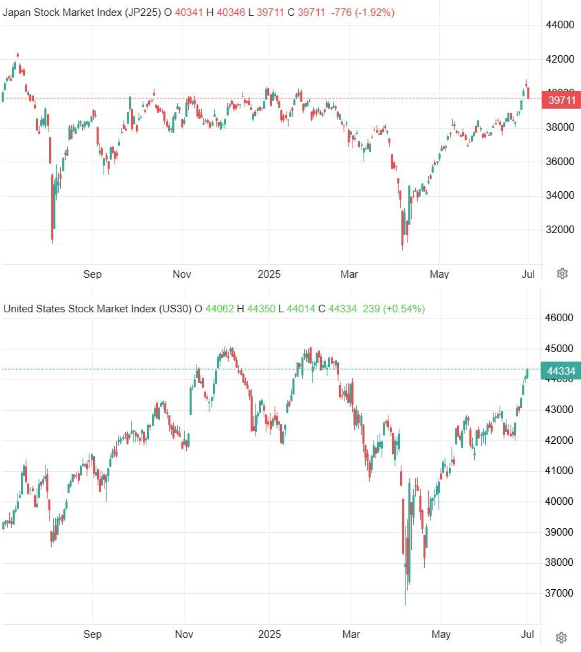

In this context, as we have previously highlighted, the investor of 2025 and indeed over the next three years, especially up to the U.S. midterm elections is not simply called to predict the future, but to manage risk, capitalize on market divergences, and take advantage of the dislocations we had noted in previous articles. For instance, European indices were recording high gains while U.S. indices were moving in deep negative territory from the beginning of the year; by the end of H1, not only had that gap closed, but several equity indices and sectors were already trading at or near new yearly highs as we will further demonstrate with data later in this article.

This is proof of our consistent stance throughout previous publications that this is a critical time for investors. Amid the narrative of uncertainty and the dissemination of supposedly “negative sentiment,” a well-positioned investor with a sound strategy could have achieved significant returns even in the absence of the major developments we are still expecting, as previously mentioned.

As we noted earlier, 2025 continues to deliver historical statistical movements: the largest dollar drop in a six-month period since 1973; the worst-performing first 100 days of a new U.S. president since 1928; the global markets moving contrary to U.S. markets; the highest daily market swings in both directions; and, notably, the divergent behavior of central banks, with the Federal Reserve moving, for the first time, sharply against prevailing

interest rate policy trends. All this amid an aggressive effort to destabilize sentiment and spread excessive fear over a possible third world war.

These and many more factors are in our view as advisors key elements to be leveraged by investors, and this is just the beginning of a strong upward and profitable phase. If you observe the following statistics, it will become clear how significant this period has been for active investors.

Statistics as of June 30th:

Indices with a positive YTD and new yearly highs:

- S&P 500: +4.84%

- Nasdaq: +7.20%

- EUR/USD: +13.93%

- ATHEX: +27.10%

Also showing gains:

- Dow: +3.55%

- EuroStoxx: +9.15%

- DAX: +19.93%

- CAC: +3.92%

- FTSE100: +7.74%

- Russia: +26.20%

- BTC: +14.80%

- 10Y US Treasury Yield: +3.50%

Sector Performances:

With new yearly highs:

- Industrial Sector: +11.90%

- Technology Sector: +8.90%

- Communication Sector: +12.15%

Also positive YTD:

- Financial Sector: +8.30%

- Utilities Sector: +7.70%

- Materials Sector: +4.40%

- Real Estate Sector: +1.70%

- BDI: +49.3%

It’s worth noting the nearly 10% decline in oil prices since the beginning of the year (with a possible upward rebound from current levels), and of course, the recent stabilization of the VIX in the 17-19 range. The VIX remaining below the 21-level threshold is key for maintaining the current bullish momentum.

From a technical standpoint, there are significant opportunities in the U.S. market. Even as this article is being written, thousands of companies are trading at heavily undervalued price levels, based on our models. We remain firm supporters of the right investment strategy to seize such opportunities, and in our upcoming article, we will present a more detailed breakdown of the opportunities previously highlighted and validated as highly profitable.

A major date that may act as a market turning point is July 9th, 2025 when the tariff extension imposed by President Trump is set to expire. If these tariffs are extended again, it could force Fed Chair Powell to abandon his inflation-fear narrative stemming from trade policy. In that case, the Fed may be pushed to act more swiftly toward rate cuts, offering another layer of relief for the markets and increasing the likelihood of sustained upward momentum continuing the trend we’ve tracked through the first half of the year, which we had identified as a pivotal phase leading into the decisive second half.

As we stated in previous articles, we continue to believe that, just like in recent months, uncertainty and fear will keep fueling risk appetite. And since we live in an age of speed, fear can swiftly be replaced by euphoria and then by greed. This is how an investment strategy should operate not by reacting to headlines or fashionable themes that have already been priced in. As we all know, markets move ahead of the news they do not react once the event occurs.

That is why you need an advisor who can correctly interpret the signs of the times and position you appropriately with a tailor-made strategy that matches your risk tolerance and return expectations as an investor.

With this mindset, we aim to help our readers and clients make the most of the big picture of the markets, the opportunities, and the developments that are unfolding in the near future. We repeat: the biggest returns are often born in environments like this.

Feel free to contact us or Maritime Economies for more information about these investment opportunities.

As an investment advisor, I firmly believe that opportunities are always present but sometimes, the right timing and the right momentum are what truly make the difference and lead to optimal returns.

by Kotsiakis George