Last week was particularly important for President Trump’s agenda and how the economic benefits could be reflected in the U.S. GDP.

With his trip to the Middle East and the ratification of major agreements and investments worth at least $2 trillion, President Trump returned to the U.S. for final discussions and meetings regarding approximately 25 tariff-related agreements.

We believe that in the coming days, positive agreements on tariffs will start to be announced — agreements that will follow a logic similar to that of China, namely to generate significant annual revenue for the U.S. federal budget.

The 90-day extension with China provided investors with breathing room and reduced uncertainty — something clearly reflected in the performance of the U.S. stock market last week.

At the same time, for the third consecutive time, inflation data was announced better than expected. Over the weekend, many economists stated that, based on recent developments, recession fears for the U.S. economy are no longer as severe as previously anticipated.

As Donald Trump’s return to the international stage becomes increasingly likely, the geopolitical balance in the Middle East is shifting rapidly. New diplomatic agreements with key Gulf players — from Saudi Arabia to the United Arab Emirates — are reshaping the pillars of energy, defense, and trade.

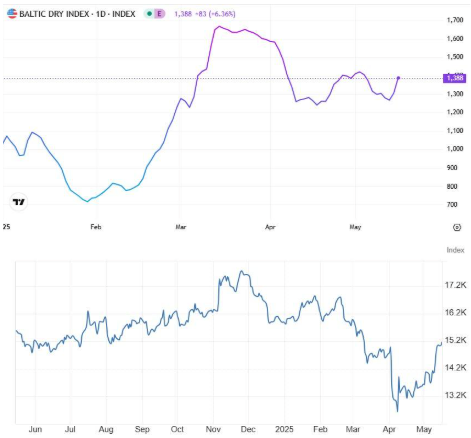

This new approach opens a window of opportunity for global shipping, which is once again positioned at the center of strategic and commercial flows between East and West.

Trump’s potential agreements with Middle Eastern countries:

- Will strengthen the energy and strategic importance of maritime routes

- Will lead to increased transportation activity across multiple shipping sectors

- Will bring the Eastern Mediterranean and the Persian Gulf back to the core of maritime geoeconomics

Significant developments and investment opportunities will arise from:

A direct surge in demand for containers, fleet and capacity restructuring, a boost in dry bulk transport — raw materials & components — a restart of the global supply chain, and naturally, a bullish explosion in the global trade balance.

This could be a catalyst for accelerating global economic growth, increasing the profitability of countries and companies that play a leading role — and, of course, the shipping industry itself.

Another critical factor that must be considered in this equation is the war in Ukraine. We believe that the benefits of resolving the crisis will be immense, and in our opinion, it is likely to be resolved by summer.

If — within the broader picture and during the 90-day tariff pause with China — the Ukrainian issue is resolved or substantially de-escalated, the impact on global trade and shipping could be massive and multidimensional.

This can already be seen in the Dow Jones Transportation Index, which we have long highlighted in our articles.

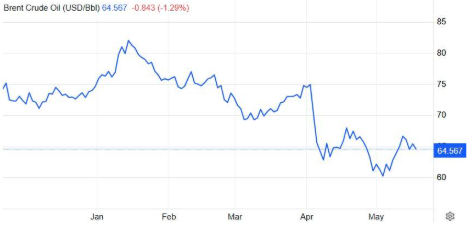

We believe the shipping sector is entering a highly dynamic period, and given the stability we observe in oil prices around $60 WTI, $64 Brent, and $620 gasoil — particularly with the EU’s transition from 0.5% to 0.1% fuel sulfur limits effective from 01/05/2025 — the investment opportunities for Greek shipping companies and others will be significant.

Let’s not forget that in a previous article, we emphasized the importance of President Trump’s meeting at the White House with Norway — a meeting we do not believe was randomly timed. On the contrary, it was a well-thought-out move, as Norway holds a strategically important position with multiple benefits, especially regarding the Ukrainian issue.

If the war ends and the EU maintains its distance from Russian natural gas, Norway will remain a key LNG supplier.

Norwegians can offer expertise in offshore wind and green energy, actively contributing to the reconstruction of Ukraine’s energy infrastructure. Norway is also a global leader in offshore support vessels and related services.

In all our articles, we have highlighted that the events taking place since January 20, 2025, are not coincidental but part of a very strict timeline initiated by the U.S. government — a Global Reset that is already unfolding and will gradually begin to be positively reflected in economic indicators and geopolitical dynamics.

From an investment perspective, if one combines this with the rapid growth of AI, the potential for huge opportunities, valuations, and profits becomes evident.

And considering that U.S. indices have remained in negative territory since the beginning of the year, the time lost by an investor not being positioned in this market — at these levels — could work strongly against them in terms of returns.

Feel free to reach out to us or Maritime Economies for more information regarding these opportunities.

As an investment advisor, I firmly believe that opportunities always exist — but sometimes, timing makes all the difference.

by Kotsiakis George