Introduction

The global maritime industry, a cornerstone of international trade, is currently navigating turbulent waters due to recent policy shifts by the United States. President Donald Trump's imposition of sweeping tariffs on imports from China and the European Union has disrupted established trade routes, altered freight rates, and introduced significant volatility into the commercial shipping sector. As stakeholders convene at the Nor-Shipping exhibition in Norway, it is imperative to assess the ramifications of these tariffs on maritime commerce and explore potential strategies to mitigate their impact.

The Tariff Landscape: A New Era of Protectionism

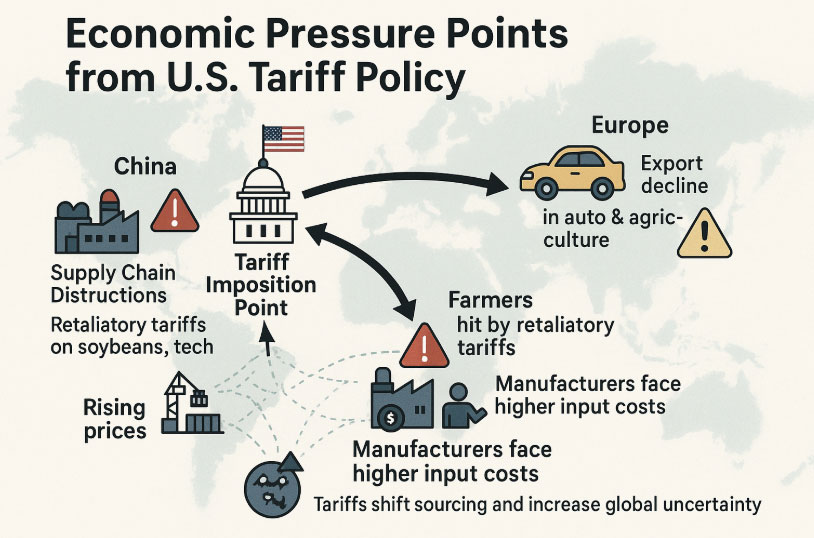

In April 2025, the Trump administration unveiled a comprehensive tariff regime, dubbed "Liberation Day" tariffs, introducing a baseline 10% duty on all imports and escalating to 145% on specific Chinese goods. Additionally, the longstanding de minimis exemption, which allowed duty-free imports under $800, was rescinded for Chinese shipments, subjecting low-value parcels to substantial tariffs. These measures have been justified as efforts to rectify trade imbalances and protect domestic industries. However, they have been widely criticized for their potential to ignite trade wars and upend global economic cooperation.

Immediate Repercussions on Shipping and Freight

The maritime industry has felt the immediate effects of these tariffs. Major U.S. ports, including Los Angeles and Long Beach, have reported a significant decline in incoming vessels, with a 35% drop in shipments from China anticipated within weeks. This downturn is attributed to reduced import volumes as businesses adjust to the new cost structures imposed by tariffs. Consequently, freight rates have experienced volatility. While some routes have seen decreased demand, others have faced surcharges due to rerouted shipments and increased transit times. Bulk carriers and container ships, in particular, have reported shifts in demand patterns that require rapid operational adjustments.

Shifts in Trade Routes and Supply Chains

The imposition of tariffs has prompted a reevaluation of global supply chains. Companies are exploring alternative sourcing options, including nearshoring and diversification of suppliers, to mitigate tariff impacts. Southeast Asia, Latin America, and even Eastern Europe are emerging as viable manufacturing hubs as businesses seek to reduce their reliance on Chinese production. This shift has led to increased shipping activity on routes previously considered secondary, altering the dynamics of global freight movement. However, the rapid reconfiguration of supply chains presents challenges, including infrastructure limitations, regulatory hurdles, and the need for new trade agreements.

Shipping companies are now dealing with added complexity in route planning, cargo consolidation, and customs compliance. The redirection of goods from traditional hubs is causing congestion at lesser-equipped ports and stretching the capabilities of regional logistics networks. Forwarders and shipping lines are being forced to adapt with agility, often at significant cost.

European Market Dynamics and Trade Diversions

Europe, while not the primary target of the initial tariffs, has experienced indirect effects. The diversion of Chinese exports from the U.S. to European markets has intensified competition for local manufacturers. Additionally, European exporters face uncertainties due to potential retaliatory tariffs and the broader implications of a fragmented global trade environment. The European Union's response has included discussions on unified trade policies and potential countermeasures to protect its economic interests.

Moreover, U.S. tariffs on European steel, automobiles, and luxury goods have disrupted long-standing trade partnerships. Germany and France, in particular, have expressed concern about the long-term viability of transatlantic trade relations under these conditions. As European companies redirect exports towards Asian and African markets, new maritime corridors are emerging, further reshaping global shipping flows.

Impact on Charter Rates and Vessel Utilization

One of the most pronounced impacts of the tariff policies has been on charter rates and vessel utilization. With the decrease in demand for transpacific cargoes, charter rates for container ships operating on those routes have declined. Conversely, regional short-sea shipping in Southeast Asia and intra-European trade have seen a modest uptick in activity and rates. Bulk carriers, especially those transporting raw materials like coal, soybeans, and steel, have experienced erratic demand, influenced by shifting commodity flows and storage buildup at ports.

Shipowners and operators are revisiting fleet deployment strategies, scrapping older vessels, and deferring new orders. Shipyards in South Korea and China have reported cancellations or delays in newbuild orders, reflecting industry hesitancy amid economic uncertainty. Meanwhile, leasing and time-charter negotiations are becoming more cautious, with risk-sharing clauses increasingly common.

The Role of Technology and Digital Resilience

In response to the evolving trade landscape, shipping companies and logistics providers are adopting strategic measures. One of the most significant trends is the acceleration of digital transformation. From real-time cargo tracking to predictive analytics and blockchain-based documentation, technology is enabling greater transparency and responsiveness in the face of disruption.

Port authorities are also investing in smart infrastructure to handle fluctuating volumes and enhance operational efficiency. Automation, AI-driven planning systems, and integrated customs platforms are streamlining processes that were traditionally paper-heavy and prone to delays. For instance, Rotterdam and Singapore have launched initiatives to become fully digital ports, attracting cargo that might otherwise have been routed through less technologically advanced terminals.

Environmental and Regulatory Considerations

As trade patterns shift, so too does the environmental footprint of global shipping. Longer routes and less optimized logistics chains can lead to increased fuel consumption and emissions. This challenges the industry’s ongoing efforts to decarbonize and meet IMO 2030 and 2050 targets.

Additionally, regulatory compliance is becoming more complex as nations introduce tariff-related trade barriers and enforce stricter import documentation. Maritime insurance costs are rising due to increased geopolitical risk, and classification societies are being asked to reassess vessel risk profiles more frequently.

Strategic Alliances and Policy Advocacy

The current climate has underscored the importance of industry-wide collaboration. Shipping alliances, port coalitions, and trade organizations are increasingly working together to present a unified voice in policy discussions. Lobbying efforts aim to influence tariff negotiations, simplify customs procedures, and promote fair trade practices.

Nor-Shipping 2025 offers a critical platform for these conversations. Leaders from shipping lines, logistics firms, governments, and technology providers are expected to discuss frameworks for greater international cooperation. The goal is to ensure that global trade remains resilient, efficient, and inclusive despite political headwinds.

Conclusion

The trade policies introduced by the Trump administration have ushered in a period of profound change for the global maritime industry. While intended to protect domestic industries, these tariffs have triggered a cascade of effects—disrupting freight flows, destabilizing freight rates, and necessitating complex operational shifts. As the industry gathers at Nor-Shipping, the collective focus must be on adaptability, sustainability, and innovation.

Navigating this new era of protectionism requires not only strategic foresight but also a commitment to collaboration and transparency. The future of maritime commerce depends on how effectively stakeholders can adjust to these tectonic shifts and build a more resilient trade ecosystem.

By Dr. Alexandros Kelmalis

Dep.CEO Koumanias Shipping Operations

Orso Nero Rosa Yacht Brokers