The resurgence in LNG dual-fuel ship orders over methanol has been a strong theme in newbuild contracting this year.

In no sector has this been more prominent than in container shipping where methanol and LNG have swapped positions in 2024.

“LNG propulsion has re-asserted itself as carriers’ principal short-to-medium term choice on the path to decarbonisation,” analysts at Alphaliner, a leading box shipping publication, report.

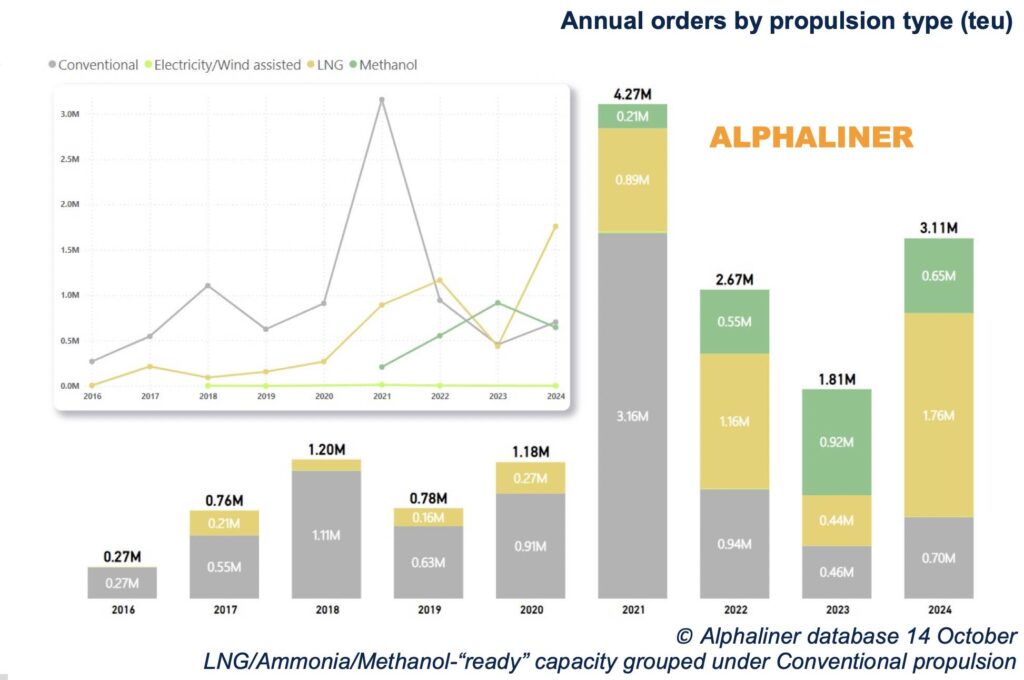

In what it is anticipating will be a record-breaking year for containership contracting, as of October 14 Alphaliner has tallied a total of 264 orders of all propulsion types equivalent to 3.11m teu. Some 77.5% of capacity ordered represents what it defines as green tonnage.

Methanol-powered ships so far represent just 21% of new capacity ordered in 2024 (see chart below), a significant drop on the 51% seen in 2023. Underlining the decline, methanol capacity contracted this year has fallen below demand for conventional tonnage again, while LNG has roared back accounting for 55% of all boxships ordered.

“Concerns over the future availability of green methanol are clearly reflected in carriers’ newbuilding orders this year,” Alphaliner noted in its most recent weekly report, adding: “Fears of insufficient methanol supply have multiplied this year as the fuel’s processing costs have proved higher than expected and planned production has failed to take off.”

With the addition of this year’s orders, the total containership orderbook is now divided 41% – 31% – 28% between LNG, conventional, and methanol propulsion, according to Alphaliner data. This does not include the 1.4m teu of LNG- and methanol – ready ships which may be converted to green propulsion further down the line.

Splash reported yesterday on Maersk’s decision to go to China for its next phase of expansion, with landmark orders for LNG dual-fuel vessels, a type of propulsion it had previously distanced itself from.

Multiple broking houses have the Danish carrier signing for six firm 16,000 teu ships at New Times Shipbuilding in a contract that comes with options for six more vessels.

It’s not just containerships where gas power has come back into favour. Lobby group SEA-LNG announced last week that active LNG-fuelled vessels now account for more than 2% of the global shipping fleet. Once the orderbook is taken into account, this number increases to 4% by vessel numbers or 6% by deadweight tonnage (dwt).

Numbers have grown from 21 LNG-fuelled vessels in operation in 2010, many of them smaller ships operating regionally, to 590 in operation globally today, including the world’s largest container ships twice the size of any operating in 2010. With a further 564 on order, the total number of LNG-powered vessels in operation by the end of 2028 will be 1,154. Added to these are 772 LNG carriers in operation, with a further 341 on order at the end of 2023. This means that over 2,000 of the world’s 60,000 largest vessels are LNG-powered. In addition, according to DNV, LNG dual-fuel vessels make up one-third of the newbuild orderbook. If dwt is used, the LNG-powered fleet in operation and on order of 142.5m dwt represents 6% of the world’s total 2.22bn dwt.

Peter Keller, chairman of SEA-LNG, said: “It is gratifying that LNG is finally gaining favour amongst so many shipowners. LNG is the only practical and realistic alternative fuel pathway available today – even for those shipowners that may also be considering other such pathways.”

Keller said the likes of liquefied biomethane and eventually hydrogen-based e-methane could be the next options for owners looking at LNG as a fuel.

Keller claimed methane slip, a cause of huge concern for many environmentalists, will be eliminated for all engine technologies within the decade.

“LNG is clearly the headline story since the summer, accounting for around 60% of all alternative fuelled new orders in the third quarter mainly thanks to a strong uptake in the container segment,” commented Jason Stefanatos, global decarbonisation director at DNV Maritime.

LNG as shipping’s primary alternative fuel choice has attracted plenty of criticism in recent years including from many NGOs and even the World Bank.

A new report authored by Robert Howarth, an environmental scientist at Cornell University in the US, has claimed that LNG exports are 33% worse in terms of planet-heating emissions over a 20-year period compared with coal.

At this month’s Marine Environment Protection Committee (MEPC) held at the headquarters of the International Maritime Organization (IMO) Ocean Rebellion, an activist group, held a protest (pictured below) demanding shipping wean itself off LNG as a fuel.

“SEA-LNG has been very successful, so successful that companies like Maersk, Royal Caribbean, and MSC have been promoting their ships as ‘green’ and selling this lie to the general public. LNG is not a green fuel,” Ocean Rebellion argued in a release.