In the past two weeks, markets have shown resilience. Wall Street moved to new records, and especially the Russell index, which is the most sensitive to interest rates when they decline, as we had previously noted, but also the index with the most undervalued companies, reached a new historic high for the first time since 2021 (and the best is yet to come). Geopolitical tensions are affecting global trade, while at the same time there are clear signals that Artificial Intelligence (AI) is evolving into a key driver of growth for the global economy. With central banks changing interest rates, markets moving with uncertainty, and shipping being tested by the Suez crisis, the 2025 landscape continues to look complex but also full of opportunities.

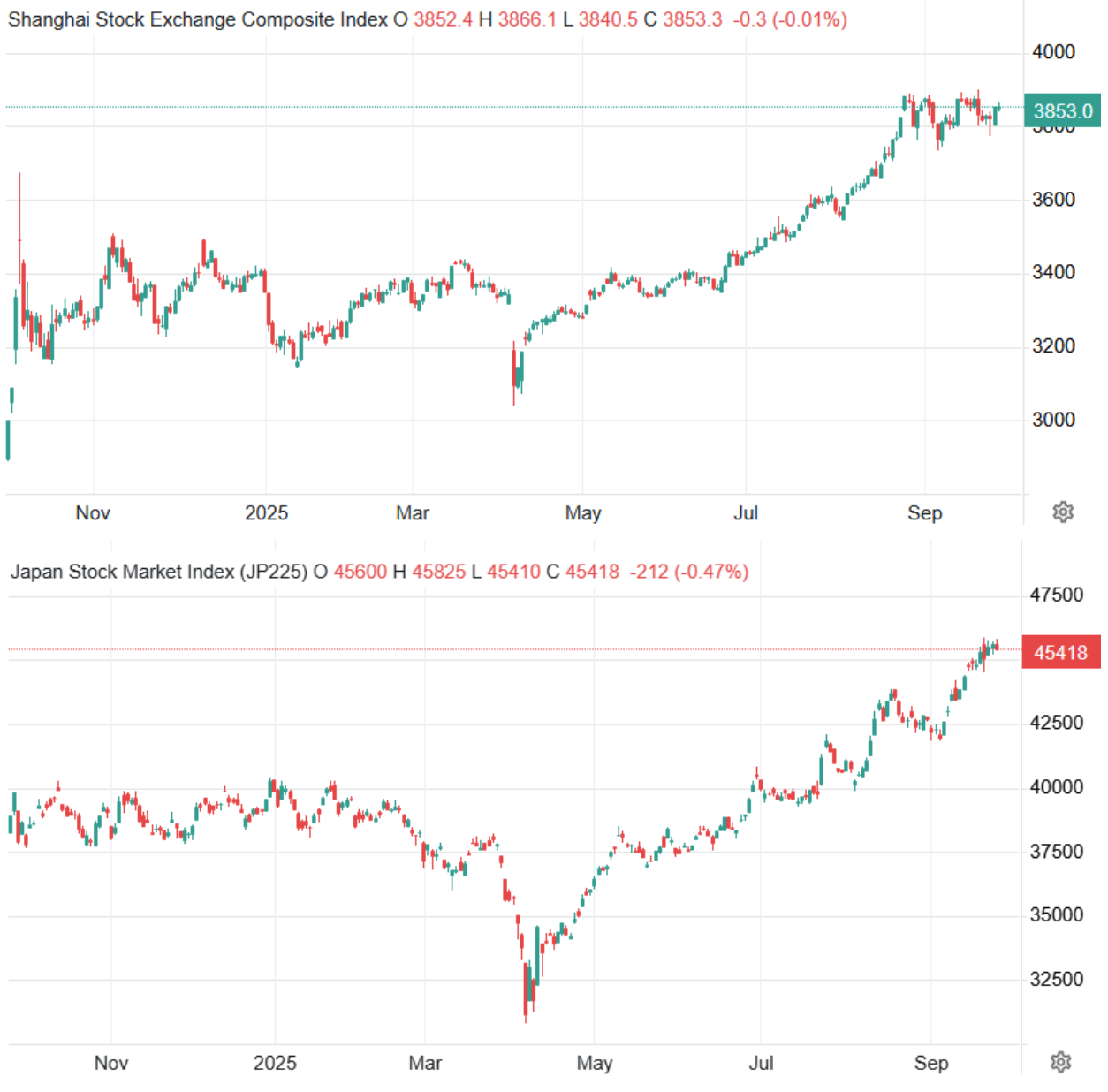

In Asia, the picture is mixed: the Nikkei 225 in Japan reached new historic levels above 44,000 points, while in China and Hong Kong the indices partially recovered, mainly in the technology sector.

The international market shows that we are in a phase of “fear of heights”: the numbers are impressive, but the appetite for risk is limited. Investors are now weighing two opposing scenarios: steady growth through lower interest rates or the possibility of a sharp correction if global demand declines.

Trade developments are crucial. The U.S. continues to push with tariffs, with the OECD warning that the full impact will be felt more strongly by the end of the year. China made a historic move by agreeing to give up the designation of “developing country” at the WTO, sending the message that it wants to appear as an equal global player (a confirmation of what we had mentioned in our Q1 articles).

This tariff war creates costs in supply chains and pressures inflation, but at the same time accelerates the geoeconomic reordering, where Asia is gaining ground as a production and trade hub.

The war in Ukraine continues to affect energy and grain markets for as long as it lasts. Our opinion on its end has been highlighted in many articles, as it will be one of the most significant factors for the growth of shipping as well as for global economic expansion. Russia increased VAT from 20% to 22% to cover the rising costs of the war and social spending, while the EU insists on its roadmap for full independence from Russian energy by 2027.

This creates risk premiums in oil and natural gas prices, as well as volatility in their stock market valuations, as we have already noted in a previous article. These are significant opportunities to exploit, either speculatively or through hedging, for those seeking ways to increase profits or reduce costs (e.g., in shipping through bunkering). At the same time, the situation reinforces the strategic importance of the Middle East and Asia as suppliers.

The Fed proceeded with the first cut of 2025 (-25 bps), bringing the range down to 4.00% - 4.25%. We estimate that the pace will continue until rates reach close to 2%, as desired by the Trump administration and Miran, who supports it with his latest statements. It is not unlikely that in one of the upcoming Fed meetings we may see a 50-bps cut, despite Powell’s attempt to justify that there are increased risks for the labor market, while inflation is retreating close to the target.

The ECB estimates that inflation will stabilize at 2% by the end of the year, while the BoE remained cautious, keeping rates at 4%. In Japan, the BoJ started, for the first time, divestments from ETFs and J-REITs, signaling a new era of more conservative policy.

The general framework is that the cost of money is gradually decreasing, as it should have started much earlier, especially in the U.S. But in my view, central banks have decided to act more politically than economically with their choices, and this is a big problem, particularly when costs have risen significantly for both consumers and businesses.

Shipping remains the pulse of global trade, with Asia playing a leading role. The Drewry World Container Index fell to $1,900/FEU, marking the 14th consecutive week of decline. Asia–Europe routes are under pressure from ship oversupply, despite delays due to the Red Sea detour. The Baltic Dry Index is moving upwards above 2,200 points, and we expect much higher levels, as we have emphasized for months, thanks to increased demand for Capesize ships transporting iron ore and coal to China. A correction down to 2,000 points or even 1,750 points is possible, but it would create the base for the continuation of the strong upward momentum we have pointed out.

Asia is increasingly consolidating itself as the center of shipping: China and South Korea dominate shipbuilding, Singapore remains a global hub for logistics and fuel, while India is investing billions in its own shipbuilding and port network.

Finally, a distinct chapter in the economy of 2025 and the next five years will be Artificial Intelligence. As we have been stressing recently, its influence and the returns it has already delivered to many companies across different sectors are particularly significant. Investors who have not yet positioned themselves based on this catalyst still have time to find companies at low valuations. According to the OECD and McKinsey, AI could add $7-10 trillion to global GDP by 2030, that is, an additional 1-1.5% annually to global growth.

In this sector as well, we have emphasized the U.S. strategy to become the protagonist of developments. This is already reflected in the U.S. government’s participation in Intel and the pressure on Nvidia for synergies with Intel. And we are still only at the beginning.

September 2025 finds the global economy at a crossroads. Markets are moving higher but without signs of fatigue, contrary to what is mentioned in many media outlets. Tariffs and geopolitical tensions affect investors who do not have the full picture and often end up buying the insecurity and fear conveyed by the media. Shipping is experiencing historic realignment with Asia playing the leading role. The Suez remains in crisis, reinforcing uncertainty but also creating significant opportunities for listed shipping companies. Analysts now see limited upward potential, when until recently they spoke of recession, insecurity, and zero interest rate cuts for 2025 in the U.S.

I emphasize all these points so that you can better decipher what you read, when, and how you should evaluate it, to take advantage of opportunities in the most effective way. As I have stated many times, stock markets are discounting mechanisms, and this is the main reason for cooperating with an investment advisor.

by Kotsiakis George