In recent years, the global economy has faced successive crises: the pandemic, supply chain disruptions, and, subsequently, the war in Ukraine. The Russian invasion acted as a catalyst for profound changes in geopolitics, in energy balances, and in international trade. The economic landscape has now been radically transformed, creating a new environment filled with uncertainty but also significant opportunities.

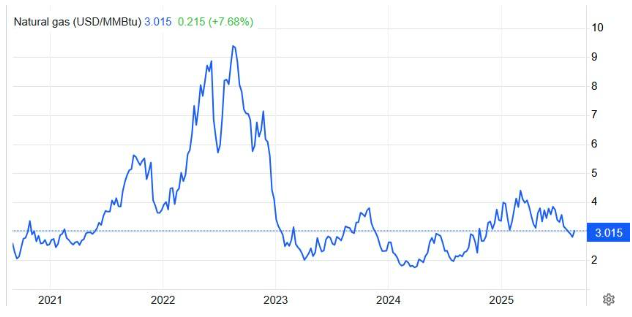

Europe’s dependence on Russian natural gas proved to be a critical issue. The abrupt interruption of energy flows from Russia exposed the vulnerability of European economies and led to a violent restructuring of energy supplies. The United States emerged as a strategic partner, increasing LNG exports to Europe. At the same time, Middle Eastern countries and Norway strengthened their position as alternative suppliers.

Nevertheless, European governments, despite rising energy costs and pressure on businesses and households, continue to insist on a hardline stance against Russia, persisting with sanctions at any economic price. They have not undertaken any substantive initiative to end the war and restore a smoother and cheaper energy supply. The result is that Europe pays a heavy price in competitiveness and growth compared to other economies that enjoy cheaper energy, and if this delay continues, the cost will rise exponentially.

Developments have redrawn the economic map. The U.S., leveraging its energy power, has reasserted its influence in Europe through strategic investments and agreements.

The major beneficiary of this new environment, however, is China. By exploiting Western sanctions on Russia, it secured access to cheap energy and raw materials, thereby enhancing the competitiveness of its industry. At the same time:

- It consolidated its position as an alternative trade partner for many countries seeking to reduce their dependence on the U.S. and Europe.

- It strengthened its diplomatic influence by expanding strategic partnerships with states across Asia, Africa, and Latin America.

- It elevated the profile of BRICS, promoting an alternative economic order that challenges the dominance of the dollar and the Western financial system.

In short, China has taken advantage of the West - Russia rupture to present itself as the leader of a new pole of power, offering many emerging economies access to financing, trade, and technology without the restrictions and political conditions imposed by the West. Beyond economics, Beijing also seeks to present itself as a diplomatic mediator in the Ukrainian crisis. With “peace dialogue” proposals and attempts to act as a negotiator with both sides, China strives to build the image of a responsible power capable of contributing to international stability. Even if this does not lead directly to a solution, it bolsters its global influence at a time when Europe appears weak and incapable of assuming a similar role.

In contrast, Europe appears “cornered,” paying more expensive energy bills, facing loss of competitiveness, and limiting its strategic role, while the U.S. and China expand their influence.

The energy crisis and surging food prices triggered severe inflationary pressures. Yet monetary policy was not uniform worldwide. The Federal Reserve proceeded with aggressive and successive rate hikes, aiming to swiftly curb inflation, even at the expense of growth. In contrast, the European Central Bank acted more cautiously, seeking to balance price stability with the need to support economies hit by the energy shock. This divergence caused sharp movements in exchange rates (particularly euro–dollar) and drove capital reallocation across markets.

Sanctions against Russia had not only geopolitical consequences but also severe implications for international investors. Those who had allocated capital to Russian companies found themselves unable to receive dividends due to bans on cross-border payments. Likewise, holders of Russian corporate and bank bonds faced repayment problems, as sanctions effectively froze international settlement systems. This led to losses and illiquidity, creating an unprecedented situation for both institutional and private investors.

At the same time, trade relations were reshaped: Russia turned towards Asia, primarily China and India, while Western economies deepened cooperation within the G7 and NATO. Meanwhile, the momentum of BRICS+ highlighted an alternative bloc seeking to counterbalance Western dominance.

The United States did not benefit directly from sanctions but gained indirectly in multiple ways. The explosive rise of LNG exports to Europe secured long-term energy contracts. Its defense industry was strengthened by Europe’s need to replenish arsenals and by continued support for Ukraine. Its financial sector became a central player in financing and ensuring reconstruction projects.

If Donald Trump manages to bring the war to an end, the consequences for the American economy will be decisive. Peace would unlock Reconstruction Funds, giving U.S. companies enormous opportunities in energy, infrastructure, technology, and logistics.

Global markets would react positively: energy prices would decline, inflationary pressures would ease, and stock markets would record powerful rallies. At the same time, America would gain political capital as a force for peace, reducing China’s diplomatic role.

In this environment of volatility, new investment opportunities emerge:

- Energy and Infrastructure: Investments in LNG, renewables, and transmission networks.

- Defense Industry: Rising demand for military equipment and security technologies opens a new growth cycle.

- Digital Transformation: Artificial intelligence and technological innovation offer new productivity gains.

- Emerging Markets: Countries diversifying their partnerships can evolve into strong economic poles.

The war in Ukraine is not only a geopolitical confrontation but also a turning point for the global economy. Diverging monetary policies, losses from sanctions, Europe’s persistence with a strategy that raises its energy costs, and the reshaping of trade blocks all demonstrate that the global economic environment has changed structurally.

Ukraine’s reconstruction will be one of the largest investment opportunities of the coming decades. Shipping will play a central role, both in restarting grain exports from the Black Sea and in transporting enormous volumes of construction materials, machinery, and energy equipment. Container lines to Odessa and Mykolaiv will resume, while war-risk premiums will fall, enabling greater activity and profitability.

Amid all this, China emerges as the great beneficiary: it leveraged the new global order to gain economic and diplomatic advantages, strengthen BRICS, and establish an alternative structure of power against the U.S. and Europe.

Yet ultimately, America is set to be the major winner. The possibility of Donald Trump ending the war in Ukraine is not merely a geopolitical development but would carry profound economic consequences for the United States. A potential Trump success in ending the war could mark a historic turning point for the American economy, cementing its supremacy in energy, investment, and technology markets, while simultaneously providing an immediate “confidence boost” to global markets.

Another decisive factor for the U.S. economy is Trump’s pressure on the Fed for a rapid cut in interest rates. If key conditions (peace in Ukraine, easing inflation, energy price stability) allow a rate reduction of more than 2% within the next 12 months, the outcome would be transformative. Currently, more than $7 trillion is parked in Money Market Funds due to insecurity and high short-term yields. Lower rates would make these products less attractive, redirecting capital toward equities, corporate bonds, and real assets. Rate cuts would also reduce borrowing costs for mortgages and business loans, fueling demand and growth.

The combination of peace, reconstruction, and lower rates would boost U.S. demand for exports of goods, services, and technology, consolidating America as the protagonist of the new economic order. International investors would turn to the U.S. as both the safest and most profitable environment. Markets would enter a new upward phase (a super cycle), fueled by liquidity, confidence, and the massive “pie” of Ukraine’s reconstruction where the U.S. will hold a leading role.

In short: the double Trump success, peace + lower rates, could go down in history as the catalyst for a new American economic super cycle.

Another strategic axis of Trump’s policy is technology. The recent large-scale investment in Intel to strengthen semiconductor production in the U.S. signals the intent to drastically reduce dependence on Asia (and especially Taiwan) in the most critical sector of the 21st century.

At the same time, the policy pursued on artificial intelligence (AI) concerns not only the economy but also national security, industry, and geopolitical power. AI can add hundreds of billions of dollars annually to GDP, enhancing the competitiveness of U.S. businesses. Control of critical technologies (AI, chips, cloud) allows the U.S. to maintain a leadership role globally. Trump seeks to prevent Chinese dominance in AI. Investments in Intel and support for American tech giants (NVIDIA, Microsoft, Google, Amazon) demonstrate the depth of this strategy.

Investors, in this new landscape, must act with strategic foresight, seizing emerging trends while avoiding the traps created by a period of prolonged geopolitical tension.

Investing is the best parallel pursuit for anyone wishing to achieve returns to their capital, especially over the next four years. Keep this in mind alongside everything I have written in my articles. Who knows, I may be proven right on this as well!

An Invitation to the Readers of Maritime Economies

We are pleased to offer all our readers a free evaluation of their existing portfolios. Through back testing and our systems, we will assess whether the risk you have undertaken corresponds to your goals and expectations.

With this approach, we seek to help every investor see the “big picture” and move forward with knowledge, strategy, and consistency.

As we always point out:

The greatest returns are often born in environments of uncertainty, and the recent period confirms this rule.

by Kotsiakis George