The global reboot is ongoing. From Washington to Beijing, and from Brussels to Moscow, governments, markets, and investors are striving to redefine their strategies.

We continue to believe that the only figure operating with a clear strategy is President Trump, whose sole aim remains the reconstruction of the American economy — making it strong once again. The pressure from debt and low revenues must return to proportions seen in past decades.

With Trump’s return to the U.S. presidency, the resurgence of trade protectionism, and the shift in geopolitical alliances, markets are entering a “reboot” phase a re-evaluation of priorities, risks, and opportunities.

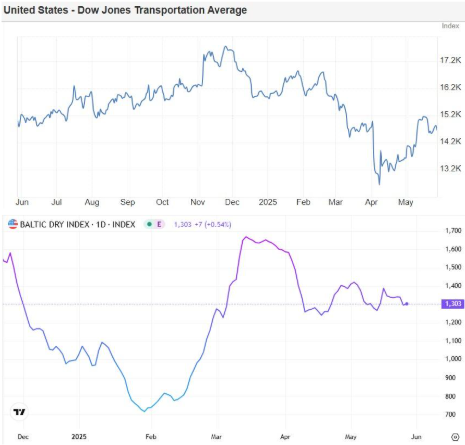

As we have emphasized in previous articles, the groundwork has been laid for a highly productive four-year cycle across several sectors, with transportation leading the way.

In just five months, Trump has managed to bring critical issues to the forefront, setting the stage for the next phases of a broader strategy one that is expected to generate significant opportunities or even “golden eras” in industries such as shipping.

In our view, the “sick man” is Europe, which still struggles to think effectively and cohesively. Over the coming years, we are likely to witness the economic consequences of these misguided political choices.

Just as we worry about America’s debt, we must also be concerned with global debt, which is at historic highs.

Trump, both as a businessman and as president, seeks to secure the most advantageous trade deals economically and geopolitically. At the same time, he aims to reshape the U.S. economy's identity: transitioning from a services-based economy to one that also includes a productive, manufacturing component, even if only partially. China, through patience and strategic planning, has already positioned itself as a high-level global manufacturing powerhouse.

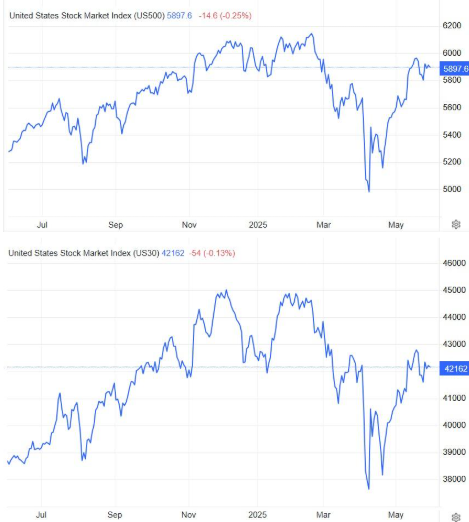

According to recent developments, court rulings have deemed Trump’s global tariff increases as legally unjustified. This could help alleviate the prevailing negativity in U.S. markets. Furthermore, this shift may alter growth and inflation forecasts, prompting markets to move from caution to a state of optimism.

Equally important were the minutes released from the Fed's most recent meeting on Wednesday, May 28, which suggested 1–2 interest rate cuts in 2025. This contrasts with analyses from several investment banks that, until recently, had forecast no rate cuts at all during 2025.

Given the recent discussions around the 30-year U.S. Treasury yield surpassing 5% for the first time, we recommend investors review the charts of TYX and TLT. They will notice that last week’s levels are identical to those seen at the end of 2023. Then they should ask themselves, are the forward-looking markets pricing in a positive or a negative scenario?

In our view, we are at a highly significant turning point. This is also evident in the shipping sector, where the Baltic Dry Index continues to hover around 1300 points. As we’ve pointed out, this level represents a strong support zone for the next major upward movement, at least toward previous highs.

Opportunities abound. In many large value companies and not just their price-to-earnings (P/E) ratios are currently at highly attractive levels. In shipping, many companies are trading below their net asset value (NAV). A major geopolitical development, such as a resolution to the war in Ukraine, would be a game changer not just for shipping, but also for numerous American companies. This aligns with President Trump’s core objective: to drive GDP growth.

We will continue to stress that we are living in a period with exceptionally profitable opportunities. The biggest mistake an investor can make is failing to take advantage of them to the extent their strategy allows.

In a previous article, we noted that during Trump’s first 100 days in office, all sector indices saw movements ranging between 26% and 43%. If we simply observe what has happened from April 7 until today, the strength of the scenario we are describing becomes evident. And all this, even before the outlook has fully cleared while positive macroeconomic indicators continue to be largely ignored by analysts.

Let us consider what may happen once positive news, developments, resolutions, deals, macroeconomic data, begins to be priced in more optimistically by the markets.

This is the core role of a professional investment advisor: to position proactively and strategically based on the investor’s risk profile, before the phase of euphoria, and eventually greed, sets in.

Some move cautiously or with fear. Yet prevention and patient observation have always proven more effective during crises.

Feel free to contact us or Maritime Economies for more information on these opportunities.

As an investment advisor, I firmly believe that opportunities always exist, but it is the right timing and the right momentum that truly make the difference and lead to ideal returns.

by Kotsiakis George