In our previous article, we highlighted that while some players act strategically with well-thought-out plans, others merely observe and try to keep pace with developments. This dichotomy was once again evident last week—particularly since Wednesday—when former President Trump announced plans to impose tariffs on a global scale.

Even during his first term, Trump was known for his bold statements and the market volatility they often triggered. However, last week’s rhetoric may have set a new precedent. Contrary to the prevailing view, we believe this second term is fundamentally different. Trump now appears more informed, more decisive, and operating under a strict timeline aimed at enacting impactful reforms to strengthen the U.S. economy.

Throughout our analyses, we consistently emphasize the structural issues at hand: the mounting U.S. national debt, persistent fiscal deficits, elevated interest rates, and the erosion of disposable income for American households. It’s important to note that under the Biden administration, national debt increased by $12 trillion, with the annual deficit now hovering around $2 trillion. Simultaneously, interest rates surged from 0% to 5.25%-5.50% in just 10 months, reaching this level on July 26, 2023.

This sharp rise in interest rates has significantly increased the cost of servicing both public and private debt, creating a fragile and potentially explosive financial environment. Historically, the U.S. economy has relied on liquidity injections to stay afloat. During the COVID-19 pandemic in 2020, liquidity equal to 30% of the prior 100 years was injected into the system—within mere months. This kind of intervention made the concept of a “Great Reset,” which became a central theme in Davos 2022, increasingly inevitable. Whether Trump is the catalyst remains to be seen, but his recent actions signal a decisive shift.

Ultimately, economic sustainability boils down to one fundamental ratio: Debt-to-GDP. This ratio improves either by reducing debt or by growing GDP. A U.S. debt haircut seems both unlikely and globally destabilizing. Therefore, boosting GDP—through any available means—may be the more viable path forward, not only for the U.S. but for the global economy.

If Trump succeeds in persuading Fed Chair Powell to aggressively lower interest rates (a move we have long considered a necessity), the resulting interest cost

savings could inject much-needed capital into both the private and public sectors. However, this must be executed without undermining confidence in the system—a critical component for sustaining both investment flows and corporate sentiment.

Another key variable in this economic equation is the U.S. dollar. The debate over whether it should remain strong or be intentionally weakened for export competitiveness is ongoing. Trump’s top advisors, Bessent and Miran, hold opposing views: Bessent supports a strong dollar, while Miran advocates for a weaker currency. Our view leans toward a strong dollar policy—possibly even below parity with the euro—for strategic pricing advantages outside the U.S. (Details on this are shared more extensively with our private partners.)

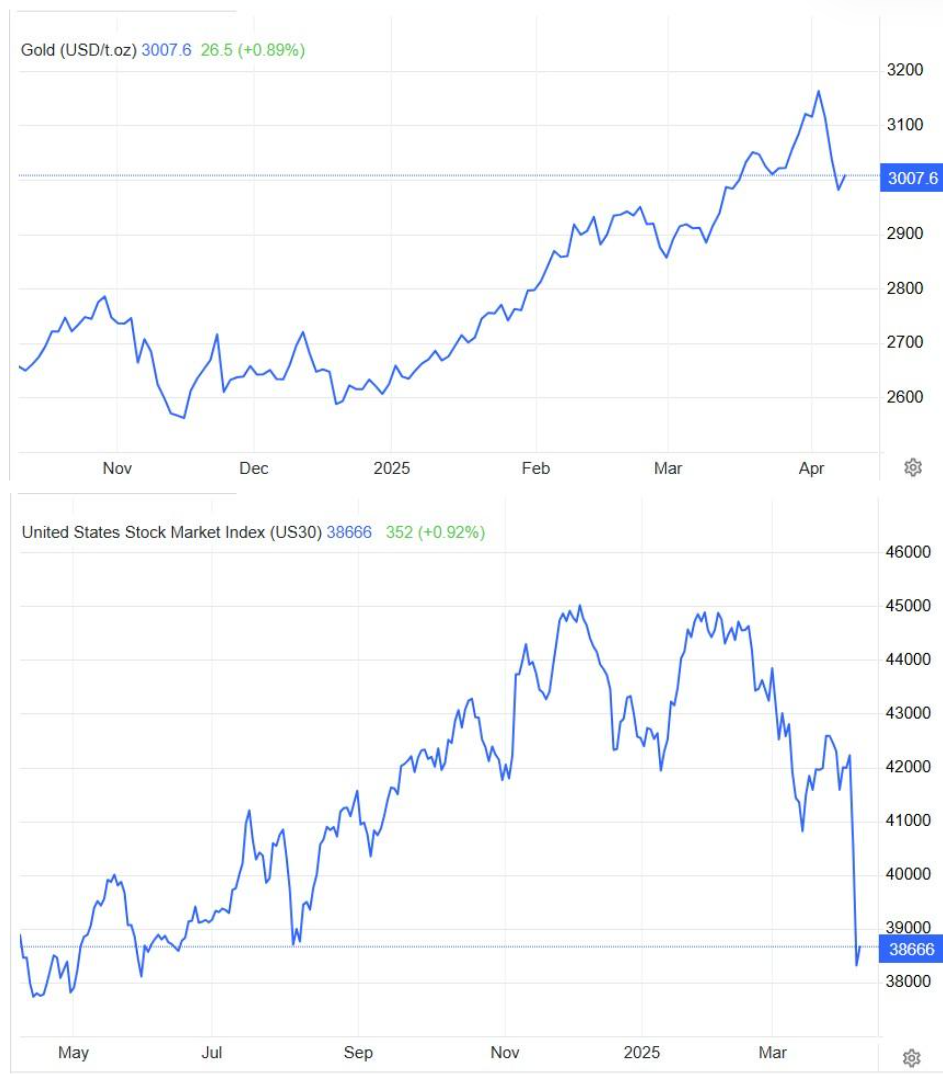

As for recent market movements, we see no cause for concern. In prior analyses, we warned that many overhyped equities were due for correction. Index performance has diverged significantly from that of select value stocks. The verbal interventions from policymakers, or what we’ve previously dubbed “verbal QE,” have not only sustained but multiplied opportunities across global markets.

One notable example is crude oil. With WTI trading around $60 and Brent near $64, we view these as attractive entry points for short-term trades and long-term upside potential.

Moreover, recent declines in the 10-year Treasury yield, gold, and silver—combined with $7 trillion parked in money market funds—lead us to believe that the likelihood of significant negative surprises is low, at least through the end of the month. That period also marks the first 100 days of Trump’s return to office, a milestone that should coincide with key announcements and tangible progress on his outlined economic reforms.

There are numerous open fronts that could yield positive developments: interest rates, corporate investments, reciprocal tariff reductions, increased systemic liquidity—and most critically, geopolitical stability. Amid global volatility, we believe the current pause in risk-taking may soon give way to a wave of high-impact opportunities, especially in the investment sector.

Economic restarts have historically delivered exceptional returns. At this juncture, those returns are not just exponential—they are multiplying.

We remain at your disposal for any questions or deeper discussion. Given recent developments, we felt it important to share our perspective and strategic lens through which we interpret and act upon these unfolding dynamics.

by Kotsiakis George