What does ‘CSRD’ stand for?

CSRD stands for Corporate Sustainability Reporting Directive, and it is an EU-imposed set of requirements for companies within its scope to publish a range of disclosures on environmental, social, and governance (ESG) topics.

Do Greek companies need to comply?

Yes. Greek companies must comply as the CSRD has been adopted by the Greek Legislation in early December 2024, following the passing of Greek Law 5164/2024.

What is the deadline?

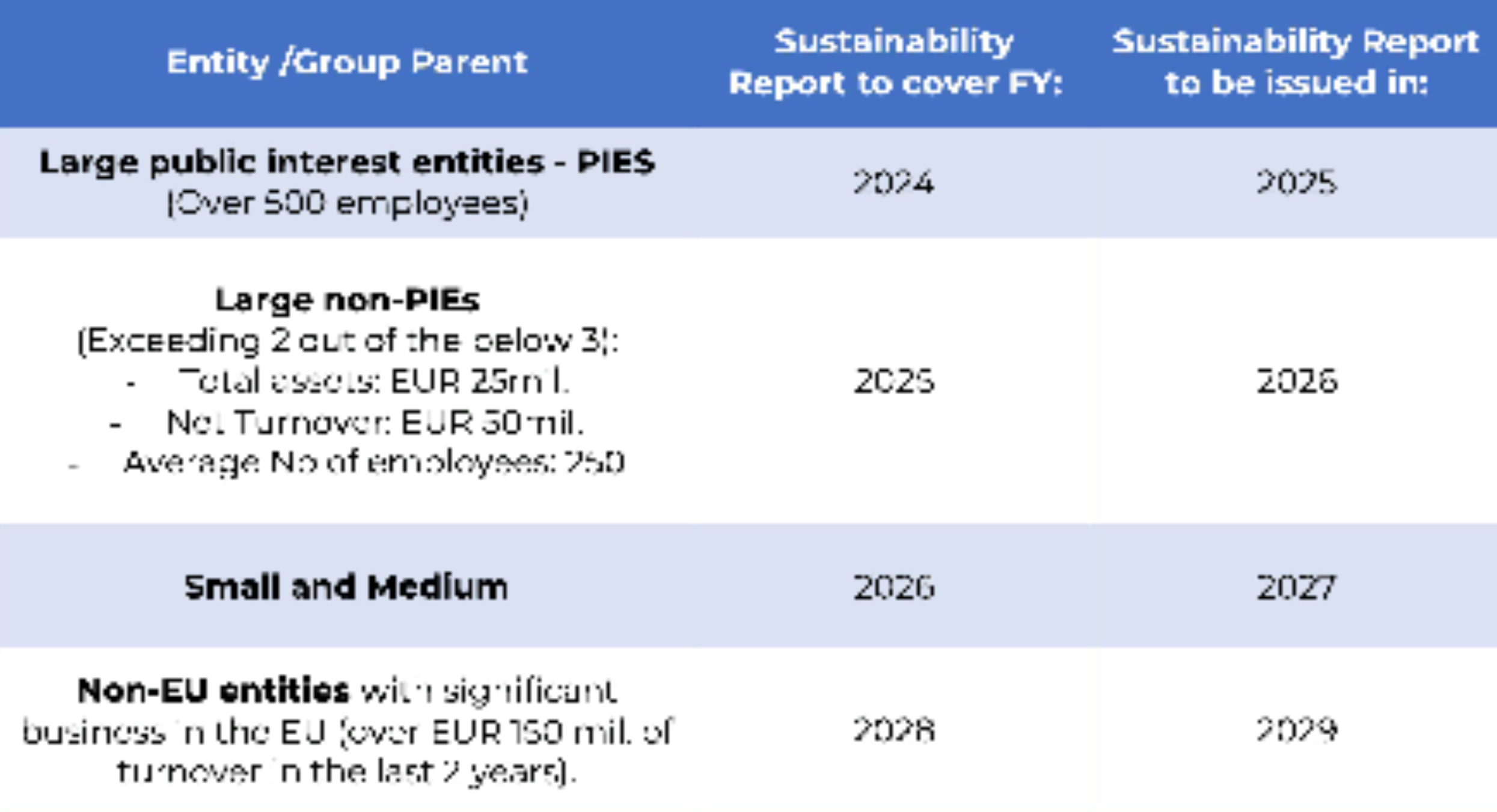

The deadline depends on whether a company is a public interest entity and, on its size, (in accordance with the revised limits introduced by Greek Law 5164/2024): (table below)

Does CSRD apply to Shipping companies?

It applies to EU incorporated shipping companies that meet the above criteria (such as companies incorporated in Cyprus, Malta etc). At present, CSRD does not apply to offshore (eg. Marshal Islands, Panama, Liberia) ship-owning companies or offshore management companies, whose only establishment in the EU is the branch of Law 89.

What needs to be reported?

The Sustainability Report is a separate report that needs to be aligned to the Audited Financial Statements and contains links to them. The annual financial statements and the sustainability report should therefore be prepared in conjunction with one another, following the notions of integrated reporting and integrated thinking. Reporting entities must report both retrospective and forward-looking sustainability data, and will also be required to share short, medium, and long-term goals. In specific, the report should contain both qualitative and quantitative information related to:

- The strategy, policies and targets relating to each of the sustainability areas (Environmental, Social and Governance).

- Environmental impacts and relevant risk and opportunities.

- Impacts on the employees and their related risks and opportunities.

- Governance policies, especially those relating to ethical business conduct.

- Governance structures, especially those that capture and ensure that E, S and G are considered in decision making.

- Impacts of the company on various aspects of the supply chain.

- Impacts of the company on its affected communities.

- ESG targets and progress in reaching them.

- Double (impact and financial) materiality assessment. Double materiality focuses on two perspectives: (a) how a company impacts the environment and society, and (b) how sustainability risks and opportunities impact the company’s financial performance and position.

- External Assurance Report.

What sustainability standards need to be followed in the preparation of a sustainability report under CSRD?

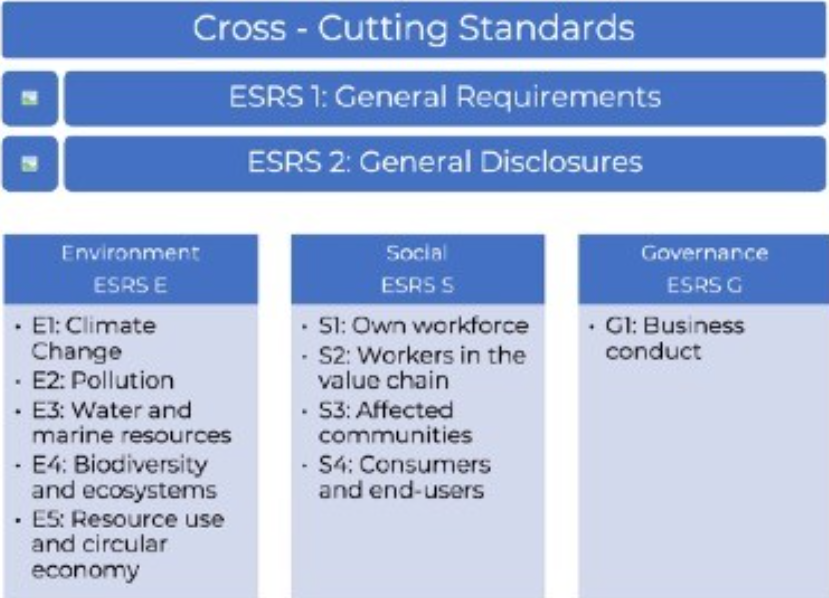

The European Sustainability Reporting Standards (ESRS).

These standards were developed by the European Financial Reporting Advisory Group (EFRAG). Here is a quick overview of the structure and topics they cover: (picture above)

Sector specific standards are under development as well as SMEs proportionate standards.

What if a company has already started with sustainability reporting but followed other standards and/or frameworks such as GRI, SASB, TCFDs, UN SDGs? Is all that now useless?

Absolutely not. The ESRS specifically allow for preparers of sustainability reports to utilize other standards and frameworks, especially in areas where there are overlaps and particularly in the absence of sector-specific standards.

Is external assurance required?

Yes, it is mandatory. The auditor of the financial statements can also provide assurance on the sustainability report, something that makes sense given the links between the two reports. Having said that, assurance can be provided by another auditor or assurance provider.

Limited assurance is required in the first three years following implementation of the CSRD, then reasonable assurance is expected to be required.

The International Standard on Assurance Engagements (ISAE) 3000, widely used for the provision of external (limited) assurance to sustainability reports has been replaced by the International Standard on Sustainability Assurance (ISSA) 5000, an assurance standard that is completely focused on sustainability.

What if a company in scope of the CSRD fails to publish a report or makes false statements in the report?

There are legal consequences for knowingly making false or misleading statements in the sustainability report, or for not disclosing the required information. In accordance with Greek Law:

- Board of Directors face imprisonment of up to 3 years and a monetary fine between EUR 5,000-EUR 50,000.

- Auditors and Assurance providers also face imprisonment of up to 3 years and/or a monetary fine between EUR 10,000-EUR 100,000.

Where do we start?

1. Start by ascertaining the fiscal year when CSRD will first apply to your entity.

2. Make sure management understands the requirement and commits the necessary resources to the project.

3. Then familiarize yourself and your team with the ESRS and consider reports of listed entities in your sector that you can use as reference points.

4. Consider the need to get external help in the various stages of the preparation of the report. If you do, make sure your consultant understands your sector and scale of operations.

5. Appoint an auditor or assurance provider for the sustainability report and ensure that they are involved early on. This will make things run more smoothly.

6. Engage your stakeholders and assess your material topics that will determine what needs to be disclosed.

7. Gather the information, validate it and start drafting the report!

By Pinelopi Kassani

Governance, Risk and Compliance

Partner Chartered Accountants Moore Stephens S.A.